This may be joyriding in the obvious-mobile, but commissions and other fees/expenses are a big deal in trading. I pointed out a few months back that it could cost you about 1/6th of your profits in the speculative alternatives portfolio to use a broker with the wrong type of commissions structure. I want to explore that idea in a lot more depth now. It turns out that commissions put very fundamental boundaries on what sorts of trading you can make money at. They’re a fundamental part of the market’s structure in the same way that auction market dynamics and FIFO ordering are. Failing to understand this point cost me a lot of money along the way – certainly many thousands of dollars. Let me see if I can explain what I learned for that expensive tuition.

The first thing to know about commissions is that you should minimize them. Yeah no shit, right? Do a little research and find a broker that charges as little as possible for the kinds of trades you want to make. That’s not the point of this article though. Anyone who can do basic math and comparison shop can solve that problem. Let’s assume you already have and move on.

The second thing to know about commissions is that they shouldn’t be viewed in absolute dollar terms. They exist in relationship to the underlying bet you’re making. Paying $50 in commissions may suck, but it doesn’t suck so bad if you’re paying that fee to make a trade that on average wins you $500. Then the $50 is just a cost of doing profitable business. On the other hand, paying $50 to take a trade on which you expect to earn $57 is a lot more questionable. In that case, you’re not really trading for yourself. You’re trading to make your broker rich and hoping to keep a $7 pittance for yourself. And of course paying $50 to make a trade with a $47 expectation is just plain daft.

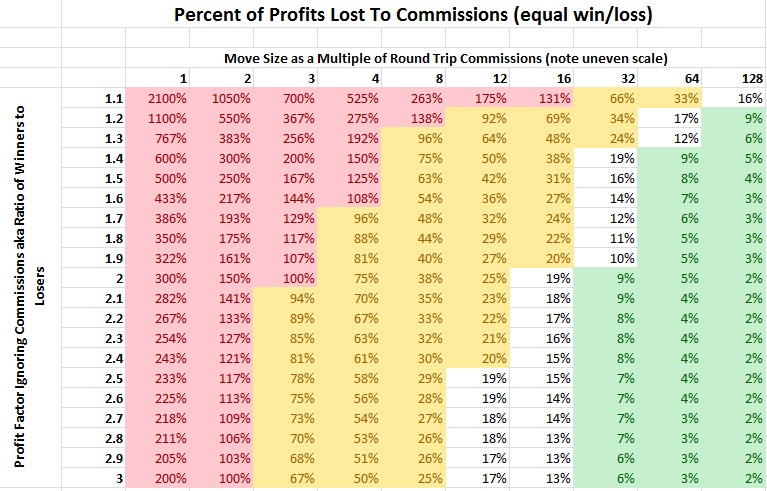

That sort of thinking is all well and good, but there’s a minor problem with it. In order to know if your commissions are going to be reasonable or unreasonable, you need to know what your expected profit on each trade is. That’s fine if you’ve got a well though out trading system that you’ve flogged through the trading system development process. But if you discover at that point commissions render your system unfeasible then you’ve wasted a lot of time and effort. It’s much better to know up front if commissions are going to be a problem. To that end I’ve created a little table:

To use the table, start by figuring out the commissions on your instrument relative to the tick size. For example, suppose you’re trading the S&P E-mini future (ticker: ES) and paying commissions of $4 per round trip per contract. Since each tick on that contract represents $12.50 of profit/loss, each tick is basically 3 commissions in size. Now suppose you were trading in a way where you typically win/lose about 10 ticks, and win about 3 times for every 2 you lose. Your profit factor would be 1.5 and your trade size in commissions would be about 30. So you’d be paying slightly more than 15% of your total winnings in commissions.

Obviously the red part of the chart represents situations in which your commissions will exceed your profits before commissions. It’s not even worth trying to play there. Basically, unless the moves you’re targeting are at least 3x the tick size, there’s essentially no hope of making money no matter how sophisticated your analysis. You might ask who would even try to do such a thing, but it turns out in markets like US equities where the tick and the round trip commissions can be very similar you can end up in this situation if you try to make a one tick market. As a practice what this means is that you can’t make a 1-tick market in US equities unless your broker passes through exchange rebates for adding liquidity. Therein lies the real power of this chart – it helps you figure out what is and isn’t possible trading-wise.

Outside the red zone, the rest of the colors are me editorializing. The zone I’ve marked in yellow is what I’ll call the “institutional zone”. It’s possible to make money there, but a good percentage of the money made will go to fees. In general, the best players in those types of strategies will be the ones with the best fee structures, and that means big self-clearing institutions. I would recommend that new retail traders avoid that zone like the plague, and experienced retail traders go there only after very careful consideration. In contrast the green zone is what I’ll call the “retail zone”. New retail traders should only look at strategies in this zone. For example, if we go back to ES I wouldn’t try to design a strategy that targets moves less than 30 commission in size, which works out to about 10 ticks or $125 per contract.

This sort of information can be very helpful when designing strategies. To continue the ES example already in progress, we would look at a chart of ES and see that it typically takes about 5-10 minutes for ES to move 10 ticks. Obviously this varies a lot depending on news, market activity etc. But the takeaway is that it would be folly to try to trade ES on less than a 5-10min time frame with this commission structure. Now, I mentioned before that this post contained expensive knowledge. Well, when I initially started trading ES I traded targeting about 4 tick moves. My analysis wasn’t great, so my profit factor was probably at best 1.5. As you can see from the chart, that means I was deep in the yellow and paying over half my profits in commissions. Oops.

Some wit out there is now pointing out that paying 1/2 my profits in commissions still means I’m making money, and what’s so bad about that? But in fact it turns out I didn’t make money. The reason is simple – I sometimes made mistakes. With my expected profit (if I did everything perfectly) being about $4 per trade, one mistake that cost me a few ticks could be devastating. It could literally take weeks to get back to break even. And being new to trading, I made a lot of mistakes. The cumulative effect, both financial and psychological, was very bad. I was basically always trying to “recover” from some previous mistake and never getting anywhere. So another way to think of the “institutional zone” is that it’s the “you can’t make any mistakes, ever” zone. Beginners make mistakes – that’s just reality. So when you’re starting out, please stay in the green and avoid strategies that target moves less than 30x the size of your commissions. Your bankroll will thank you.