When developing trading systems, one of the first things you have to deal with is a high level decision: are you designing a method that trades most or all of the time, or only sporadically? Both approaches are potentially valid, but they require different steps during system design. Continue reading

Category Archives: System Development

Kelly Criterion Part 2: Avoid Lotteries and Reverse Lotteries

Somewhere along the way someone probably told you not to play the lottery – that it’s a dumb idea. And this is true. The typical state lottery pays out about 50% of the money it takes in as prizes. The other 50% is retained by the state to build parks or educate kids or some such nonsense 😉 It’s no exaggeration to say that lotteries are a tax on people that are bad at math – a sort of tax I heartily approve of.

There’s an interesting intersection between trading and lotteries you may not have thought about. One aspect of a lottery is the deficient payout – in the typical case $0.50 is paid out for every $1 payed in. In other words playing the lottery has a profit factor of 0.5. Another aspect is the extreme imbalance of payouts – infrequent huge wins paired with frequent small losses. This later aspect is what I want to investigate today – especially the idea of lotteries where the payoff is greater than pay-in. In other words, “good” lotteries.

Monkey Math Part 1 – Deciding If Trading Systems Work

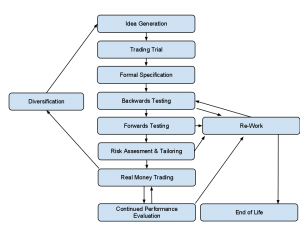

I realized this morning that it’s been almost an entire year since I wrote about the trading system development process pictured at right. That’s almost criminal, because in all that time I’ve never really gotten around to explaining the heart of the system development process: testing systems to make sure they work, and refining them when they don’t. This corresponds to the formal specification, backwards/forwards testing & re-work boxes in the diagram.

I realized this morning that it’s been almost an entire year since I wrote about the trading system development process pictured at right. That’s almost criminal, because in all that time I’ve never really gotten around to explaining the heart of the system development process: testing systems to make sure they work, and refining them when they don’t. This corresponds to the formal specification, backwards/forwards testing & re-work boxes in the diagram.

These steps are in some sense the most dangerous parts of system development process because it’s easy to fool yourself into thinking a system works when it doesn’t. Continue reading

Get Over It – They Already “Stole” Your Trading Strategy

New traders think about strategies in a very peculiar way. I started thinking about this today because I saw traffic from the following search term:

“is there anything i can do to protect my trading strategy”

Now, you may be wondering what this person wants to protect their strategy from. Marauding bandits? But maybe like me you’re not wondering, because you have (or had) the same anxiety. The possibility that you’ll go to great lengths to discover a wonderful trading strategy, only to have someone else learn about it from you and make all the money. This third party might learn your strategy because you told them, or more nefariously they might learn it without you knowing. For example your broker might watch your trades, marvel at your amazing profitability, deduce the underlying strategy, and then duplicate (or even front run) it.

Please, please, please stop worrying about all this. Continue reading

Naive Markets, Hostile Markets, and Random (Efficient) Markets

“I am not superstitious, but I avoid situations in which I continually lose.” -Barry Greenstein, Ace on the River

I want to get a few terms defined that I’m going to use in subsequent posts. Specifically, I want to talk about the way predictive methods and markets interact. My experience is that there are three basic classes of interactions:

Continue reading

Embrace Big Data and Simple Analysis

I’ve been seeing the buzzword “big data” cropping up a lot lately. As best I can tell, in business-droid speak it refers to any very large collection of non-uniform or hard to work with data. For example, all the videos on YouTube. The large part should be obvious. The hard to work with part stems with the fact that you can’t really extract any value from the videos without doing something difficult (or at least time consuming) – watching them. There’s lots of big data out there – census data, social media, credit card data, military intelligence, etc.

While I’m always loath to jump on trendy business bandwagons, I think this one is bringing to the public an idea long overdue, and which I strongly believe in:

Given a choice between having better analysis or more data, 99% of the time you’d be way better off having more data.

Problems With Phasing

I’ve been on a bit of a economics kick lately, but it’s time to get back to the real purpose of this blog, which is teaching profitable trading. A big part of that is passing on “lessons learned” – mistakes which cost me money and which you hopefully can avoid thanks to me highlighting them. One of those mistakes resulted from what I’ve termed “phasing”. Continue reading

Adjusting to Market Volatility

If you pay attention to the financial press, you’ve probably heard the markets described as “volatile” at one point or another. In this context, volatility is not merely descriptive. It has a specific mathematical meaning which can help you make better trading (or for that matter, investing) decisions. In order to succeed as a trader you need to have a strong working understanding of volatility and its implications. Continue reading

If you pay attention to the financial press, you’ve probably heard the markets described as “volatile” at one point or another. In this context, volatility is not merely descriptive. It has a specific mathematical meaning which can help you make better trading (or for that matter, investing) decisions. In order to succeed as a trader you need to have a strong working understanding of volatility and its implications. Continue reading

Profit Factor – A Means of Comparing Strategies

In order to evaluate trading strategies, it’s very handy to have one number that represents how good a given strategy is – bigger is better. I’ve suggested a couple of ways of doing that – win rate and expectation. Both are uselful, but both also have substantial limitations that render them problematic in the real world. What I want to do here is briefly describe those limitations, and then suggest an alternate mathematical construct called “profit factor” you can use for evaluating systems. Continue reading

The Trading System Development Process

You might be wondering what, exactly, it is that a trader does all day. Or in my case where I have a 9-5 job, what I do with the 3 or so hours a day I spend working on trading. If you look at the example trades I’ve posted on this blog, they don’t take very long – the Tickle Me Elmo trades were only open for a few minutes each. This morning I waited an hour and a half to take a single trade that lasted 7 minutes (a slow one by my standards). Even taking several such trades a day, there’s no way the actual act of trading is going to add up to more than about an hour of time. And since my trade entry and management is largely computer automated, most of that time when I have a trade on is really spent just sitting there making sure the computer doesn’t crash. In an average day I only spend about 30 seconds to a minute actively entering or canceling orders.

Point being, actually trading makes up a tiny part of what a trader does. Continue reading